A potential shutdown looms, as the U.S. government faces its second funding crisis in four months. Six appropriations bills funding roughly 75% of discretionary spending --including the Departments of Defense, Homeland Security, Health and Human Services, and Treasury -- expire at midnight on Friday.

To pass, and for the government to remain open, the package requires 60 votes in the Senate, where Republicans hold 53 seats. Only one Democrat -- Senator John Fetterman of Pennsylvania -- has committed to voting yes.

Republicans need six more votes. Meanwhile, Senate Democrats (for the most part, see above) have unified against the package following the fatal shootings of two U.S. citizens by federal immigration agents in Minneapolis this month, which an OddChain writer recently discussed.

Since 1976, there have been 21 funding gaps. Most recently, in October and November 2025, we experienced the longest shutdown in government history. Democrats demanded extension of enhanced ACA premium subsidies, and after 43 days, eight senators broke ranks and voted to reopen the government. Democrats ultimately lost that fight, and the subsidies expired at the end of 2025.

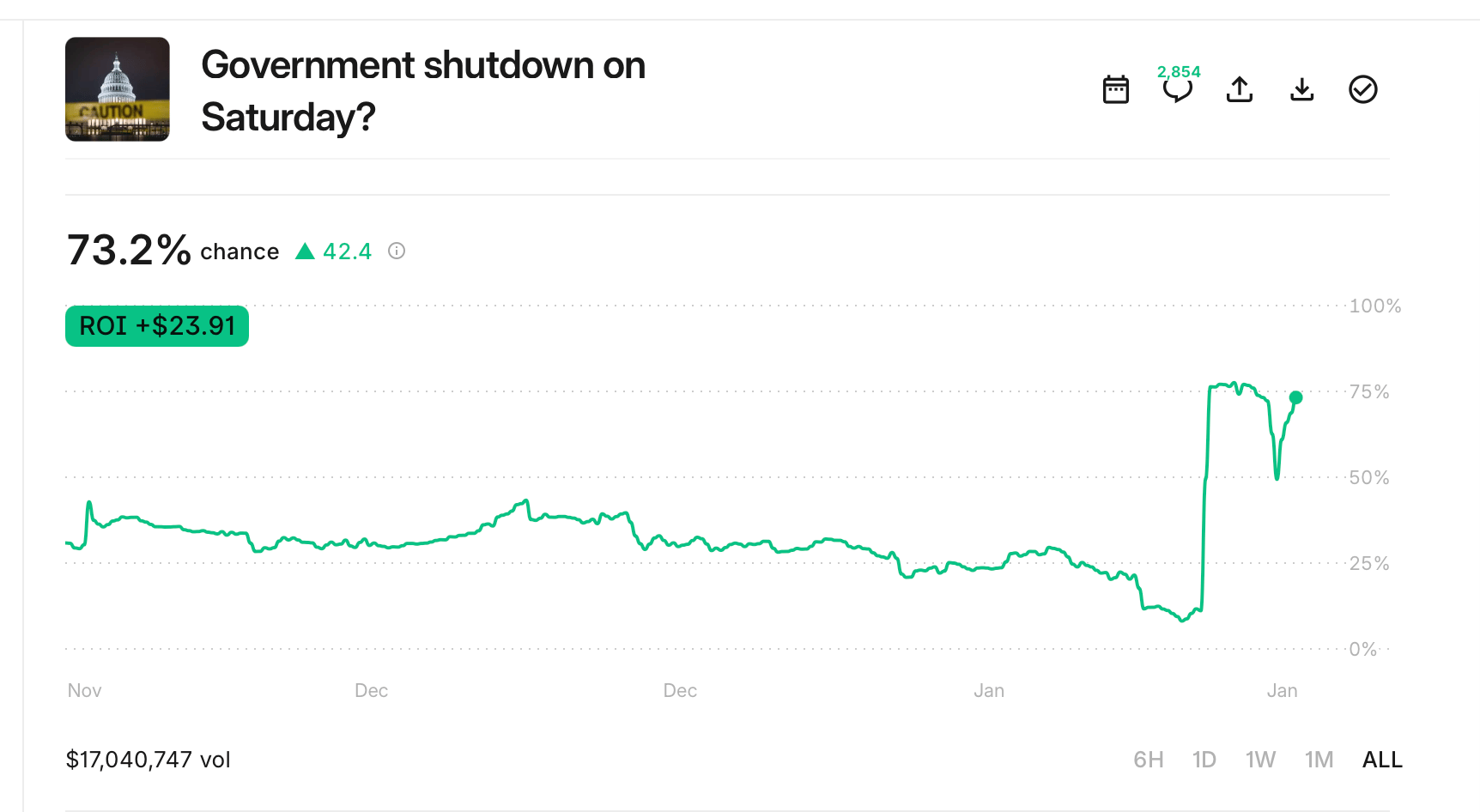

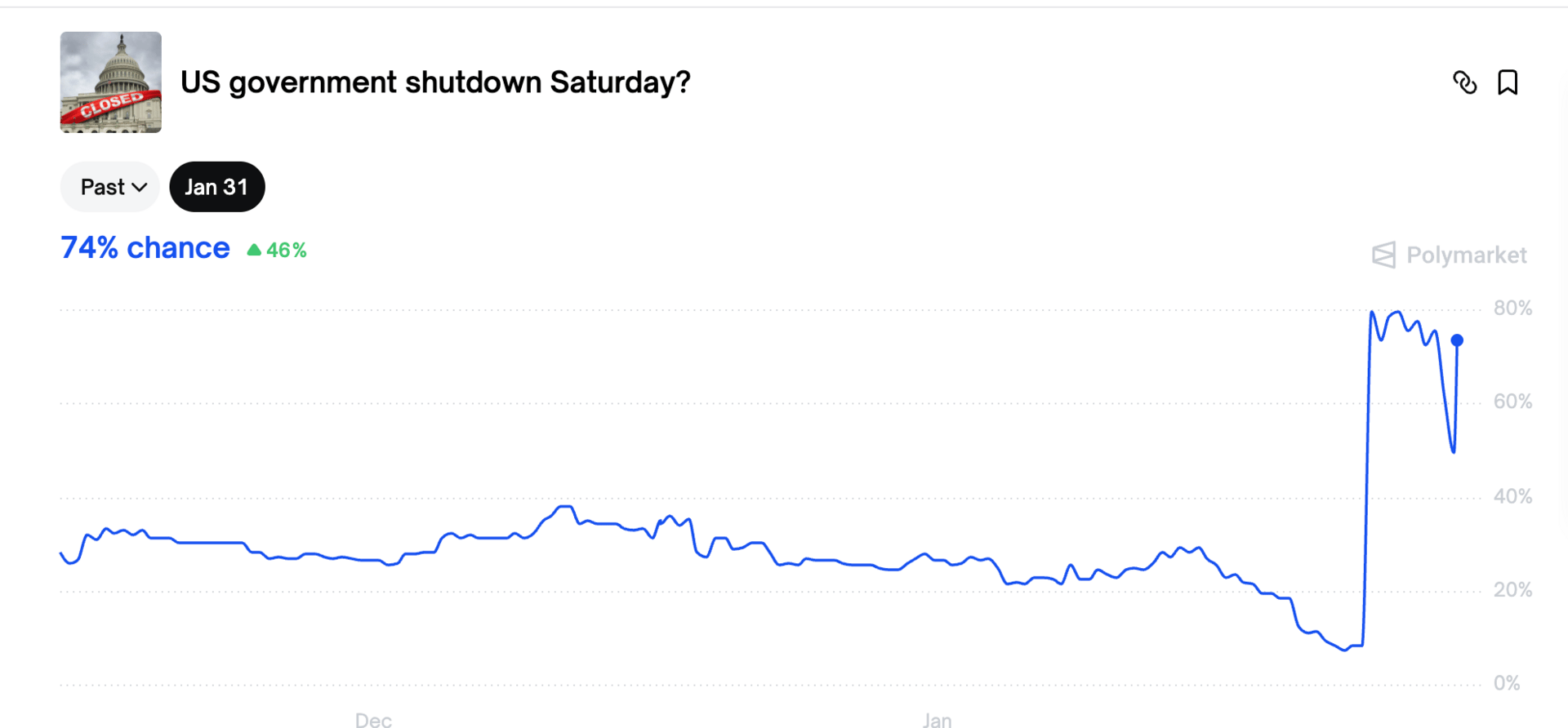

As of writing, Kalshi has the odds of a shutdown at 73.2% and Polymarket has is at 74%.

I expect there will be some price movement that can be captured as news ebbs and flows throughout the day.

Yesterday, late night reports that President Trump and Senate Minority Leader Chuck Schumer were progressing towards a deal led to a nearly 20% swing on Kalshi and Polymarket. Odds moved to close to 50-50 before adjusting this morning.

Before this -- based on research and conversations with current and former government employees -- my thesis was moving in the direction of a “Yes” being overpriced by about 11% and that was the safest approach based on the unexpected nature and rapid positional swings was to take advantage of limit orders and trade on headline-based sentiment swings throughout the day. I managed to capture 16% of the swing before bed, and I anticipate further volatility.

The markets already corrected back up this morning, I reckon due to the fact that even if Schumer and the White House come to an agreement, there may still be a funding lapse this weekend as things get sorted, and a partial shutdown would be sufficient --according to Kalshi and Polymarket’s rules of resolution -- for the markets to resolve to “Yes.”

That said, since this also relies on OPM’s website updating in time, to minimize risk traders might want to consider using limit orders as the market continues to shift based on the news.

Onchain Indicators

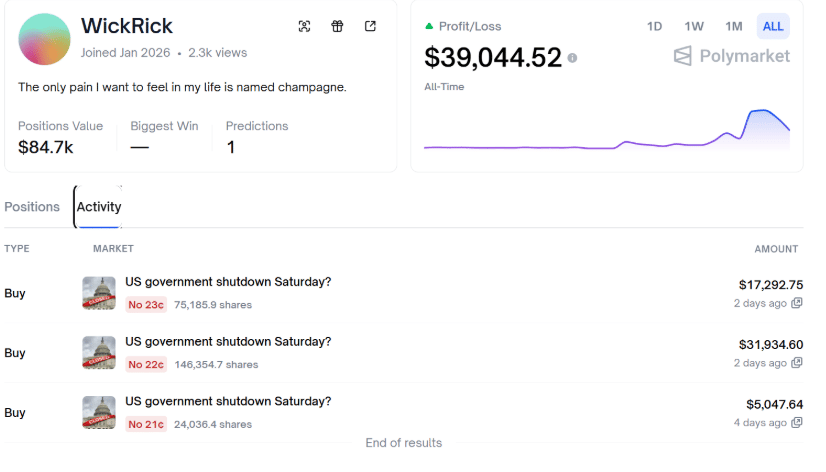

On Wednesday night, amateur Twitter sleuths flagged a number of suspicious wallets that appear concentrated on the “No” side of the market.

A common “flag” to spot a potential insider is a fresh account that takes a large position on a single market (sometimes the only market they ever bet on), and tends to market buy. (Because, as one OddChain writer puts it, why would a corrupt shmuck -- and presumably a new user of prediction markets -- know the intricacies of resting orders on an AMM?)

As of 10:30 EST Thursday, six of the top ten “No” holders have accounts that were created in the last two months, which alone certainly raises eyebrows. On closer inspection, though, the allegations of an insider cabal seem a little overblown.

One account has been accumulating their shares steadily using resting orders over a 48-hour period. Another is an active trader across multiple political markets. One started his account rather unprofitably, so if he is an insider, he’s a bad one.

The remaining three are legitimately suspicious. All bought between 22 and 23 cents. Two addresses bought in batches of three market buys around the same time, and one bought (after a test buy) first two weeks ago.

But: who knows?

Big, single-sided buys could be from traders catching the arb between Polymarket and Kalshi, which has been as large as 3%. Prediction markets are routinely hitting all time highs in trading volumes as well -- could simply be new bettors.

We’re wishing WickRick in particular good fortune in his pain avoidance strategy:

So, what’s going on and what might happen?

Initially, there was indication of progress being made in negotiations. Some members of the GOP indicated a willingness to separate the DHS bill. Thune, however, is not a fan of this, having refuted this idea multiple times and saying that “I would prefer that there be a way that we keep the package together.” If this bill were to split, the House would need to come back; Johnson has not signaled that to be the case.

Trump also signaled that he did not want a shutdown to occur, with Bessent telling CNBC that Trump was “‘urging’ lawmakers to avoid a looming partial government shutdown.”

Then, in the last day, a lot happened.

In the morning there was some optimism. Senator Josh Hawley said, "We're at a situation where this just isn't safe…" Senator Thom Tillis said, "We're losing trust with the American public on an issue that we should be winning on." And Democratic negotiators sounded hopeful, with Senator Brian Schatz saying "I think we should be able to land this." and Senator Tina Smith saying, "Nobody has said, 'That's ridiculous.'"

In the afternoon, after a caucus meeting, Schumer announced three conditions: 1) End "roving patrols" and tighten warrant requirements for arrests, 2) Establish a uniform code of conduct for use-of-force accountability, and 3) Require agents to remove masks, wear body cameras, and carry visible identification. (It’s worth noting that these demands involve legislation, which require House approval.)

Senators dismissed some of Schumer’s demands and The White House unequivocally rejected them, saying (as reported in Roll Call): “A demand for agreement on legislative reforms as a condition of funding the Department of Homeland Security with a government funding deadline just 48 hours away is a demand for a partial government shutdown.”

Politico reported that the White House is now pinning its hopes on border czar Tom Homan who was dispatched to Minnesota earlier this week to "cool temperatures." A White House official described Homan's efforts to "appease" Democrats as "the only arrow left in the quiver." There is no Plan B, the official said. "It's all wait and see."

Then the big move in the market occurred when Schumer and Trump met last night. Progress was made negotiating a framework to pass five of the six funding bills. However, complicating matters is the structural difficulty of reaching a last-minute deal. Any changes to the six-bill would force House lawmakers to return from recess to approve the revised measure, and they’re gone until February 2nd.

Why the market might resolve “Yes”:

There is no deal. In this case, the Thursday test vote fails, and there is a shutdown on Saturday. There is solidarity among Democrats, and there’s a solid chance they hold strong. Plus, Democrats who defected to end the government shutdown last time -- such as Cortez Masto -- have said they’re no’s this time around.

The package splits and there is a temporary shutdown. Several Republican senators have publicly endorsed stripping DHS from the six-bill package, and instead passing the other five measures that have bipartisan support. Again, this may still lead to a temporary shutdown. Even then, not everyone supports this; Senator Mike Lee of Utah, for example, has indicated he will reject any effort to strip DHS from the package.

Why the market might resolve “no”

The discussions that Schumer and Trump had last night pan out in a way where there is no temporary shutdown.

The Democrats cave to Republican pressure. There’s no split and no changes to the bill. This requires an additional 6+ Ds breaking ranks or Rs to agree to split. I find this unlikely as the senators who broke ranks in October -- such as Cortez Masto, King, Hassan, Shaheen, Rosen, Kaine -- have all said they're voting no this time. However, one reason they might cave is that the shutdown wouldn’t actually be a big hit to ICE. Last summer's reconciliation bill gave DHS roughly $176 billion in separate funding, including $75 billion for ICE. Senator John Fetterman has made this his central argument: "A vote to shut our government down will not defund ICE.”

Expect markets to continue to move as the news changes. Right now, it does seem to be leaning toward yes -- especially given the chances of short term shutdown even if the bill is split. However, things are changing fast, so looking to trade positionally as the market swings might be a more strategic option. Take advantage of those limit orders.

Keep an eye out for market moving headlines or for Ds breaking rank or indicating that they’re holding firm. I expect Thursday’s test vote to be a strong signal, and that there’s a good chance markets keep moving down to the wire.

A final note on the matters of resolution. We’ve written on the complexities of resolution in the past (here and here).

Both markets on Kalshi and Polymarket resolve based on the OPM website. We were not able to confirm when exactly the OPM website was updated last time. (If you know this please get in touch.) If you’re worried about the OPM website updating, you can consider setting limit orders to capture large swings in your favor while minimizing risk of resolution disputes or delays.