Here is Johnny Lodden:

Lodden is a largely unremarkable poker pro who enjoyed most of his success in the early days of Internet play, reaping a modest fortune amid the late aughts digital-Holdem boom. He has not had a significant tournament win in years, and holds no place of note in the history of the game -- aside from being the namesake of arguably the best drinking game ever invented, Lodden Thinks.

The game has been the subject of many excellent oral histories so we won’t belabor the explanation here. In short: Two much better-known poker pros -- former college roommates Phil Laak and Antonio Esfandiari -- were bored of their usual banter but nonetheless trying to vamp for tournament cameras. In a fit of brilliance, Laak invented an elegant betting framework: what does Johnny Lodden think?

An example:

Lodden, how many people live in Shanghai, China?

The actual number of people who live in Shanghai does not matter; the number of people Laak or Esdandiari think live in Shanghai does not matter; the only metric that matters is the number of people Lodden Thinks live in Shanghai, China. The same can apply for almost any question.

How many wars have involved a submarine battle?

Who will be the NBA MVP?

How many grains of sand are on the beach?

The winner is not the bettor who actually knows the answers to these questions. The winner is whoever can guess closest to what Lodden (or anyone standing in for Lodden) thinks the answer would be.

Interplay between thinker, bettor, and objective reality is what makes the game so fun. Let’s take the How many grains of sand are on the beach? example.

If I’m playing Lodden Thinks with my friends, and I know the friend who is serving as our Lodden is a bit of an idiot (surely in possession of numerous redeemable qualities, but nonetheless irrefutably dumb), I know they’re not going to apply any kind of rigorous analytical framework to the question. They’re just going to pick the highest number they can think of -- which won’t be very high because, again, they’re dumb.

To put it all differently, Lodden Thinks is the simplest version of a Keynesian Beauty Contest, another game in which the winning strategy is determined by assessing other thinkers’ mental frameworks rather than trying to determine a “correct” answer.

Predicting An Idiot’s Prediction

Polymarket has a remarkable 90%-plus accuracy rate one month out from market resolution, and that number jumps to 95% four hours out from resolution.

This accuracy is arguably the core innovation of prediction markets -- that a marketplace of bettors will, with sufficient liquidity (and therefore incentive for rational, information-gathering bettors to participate), come to guess more accurate outcomes than sportsbooks or pollsters.

But what about betting markets that remain stubbornly inefficient?

Let’s say, for example, a highly volatile betting market that does not resolve for a multi-month period? One populated by stupid, emotional crybabies?

Well, that would be a very interesting market indeed. Instead of trying to make actual predictions, one could simply play Lodden Thinks -- due in part to the time before market settlement reducing quality information and due in part to the irrational bettors, smart bettors can gamble on what they believe the dumber bettors will be doing, rather than actual outcomes.

I am talking here about sports markets.

Sports fans? Higher rates of alcohol consumption, especially among college-age fans, which are among the most likely to bet. Sports nuts struggle with emotional regulation, and have an unusually high incidence of beating their wives and families. Not ideal for society, but excellent traits in a counterparty!

Beyond these studies (the conclusions of which were stretched for the sake of comedy), one can see the glorious, stampeding animal spirits of sports fan psychology by simply perusing any social media site. A player has a good game? Consensus is that they’ll win MVP! Bad? Washed trash!

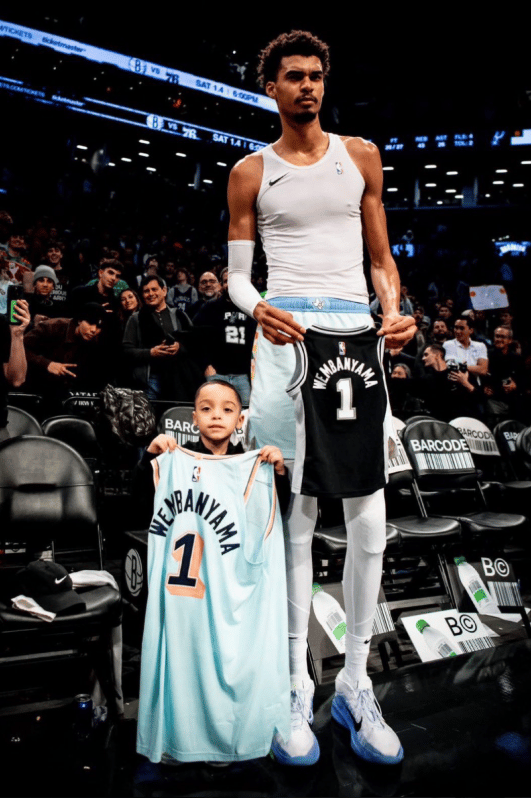

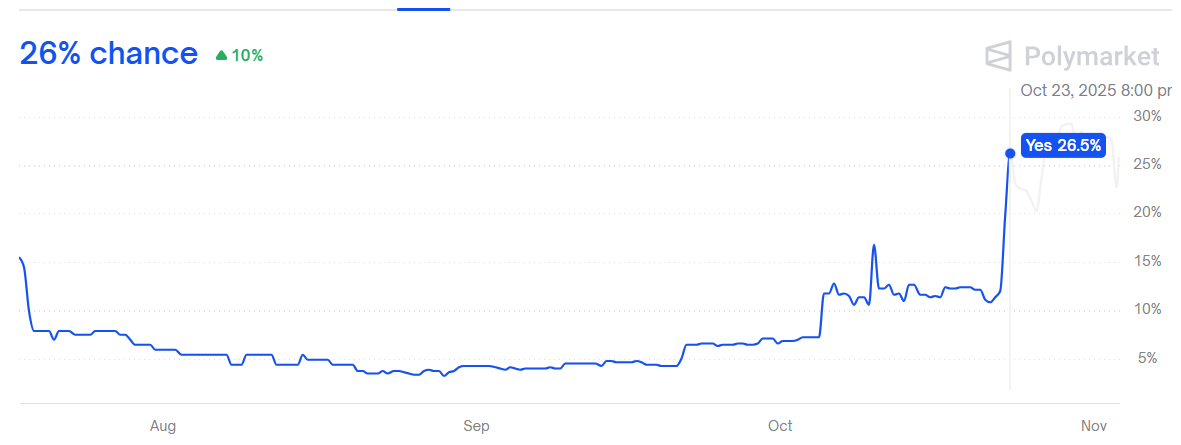

Let’s look at a concrete example of this reflexivity: Victor Wembanyama’s Polymarket MVP odds.

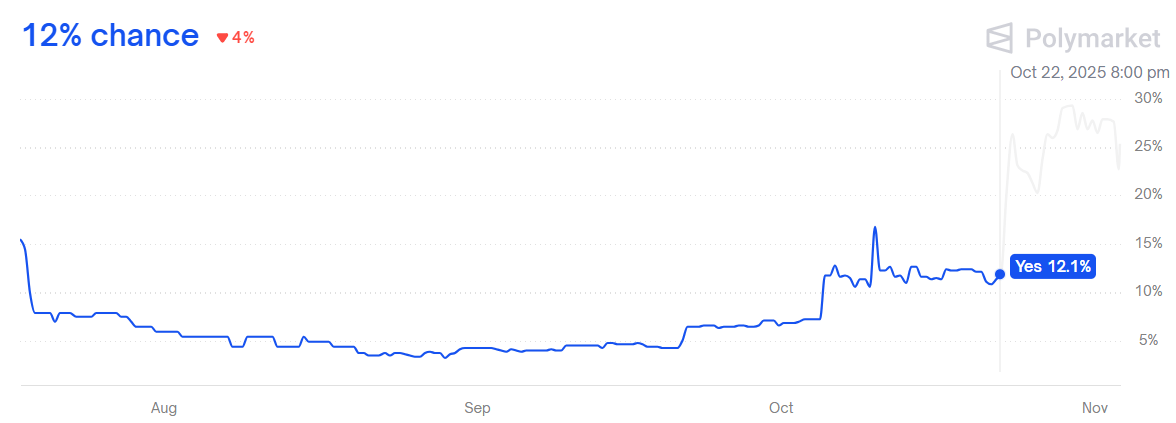

The night of October 22nd the markets gave the 7’5”, Shaolin-trained, French Slenderman imposter 12.5% odds of winning the NBA MVP. Then, during his game, he had one of the most highlight-rich openers in NBA history, dropping 40 points on a fully healthy Anthony Davis, who is one of the better defenders in the game.

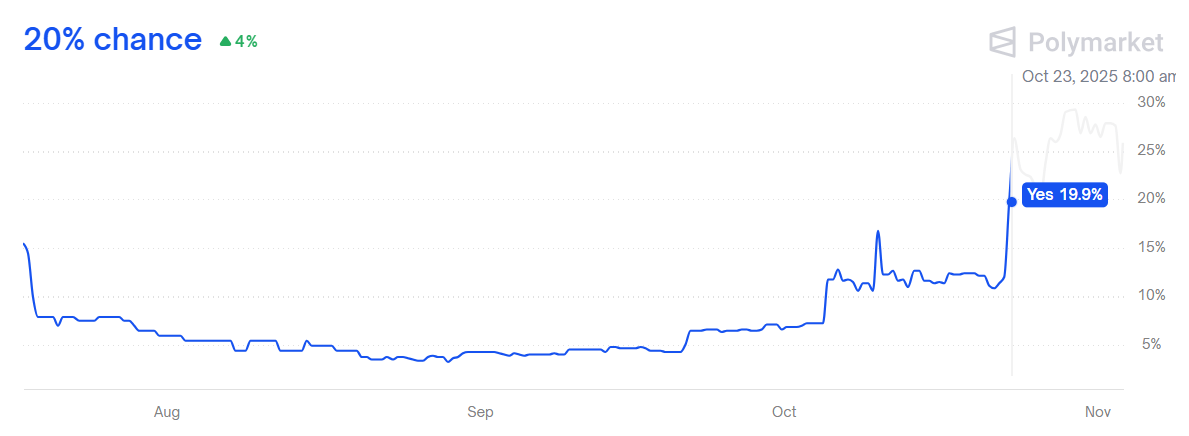

Perhaps predictably, his odds nearly doubled in 12 hours:

Arguably, this makes sense. The statement game represented new information coming to market: even with an extra year of experience and what by all accounts was a grueling summer of offseason working on his bag under his belt, bettors had not properly priced Wemby’s odds of establishing himself as the most valuable player in the league, and the market thereby adjusted.

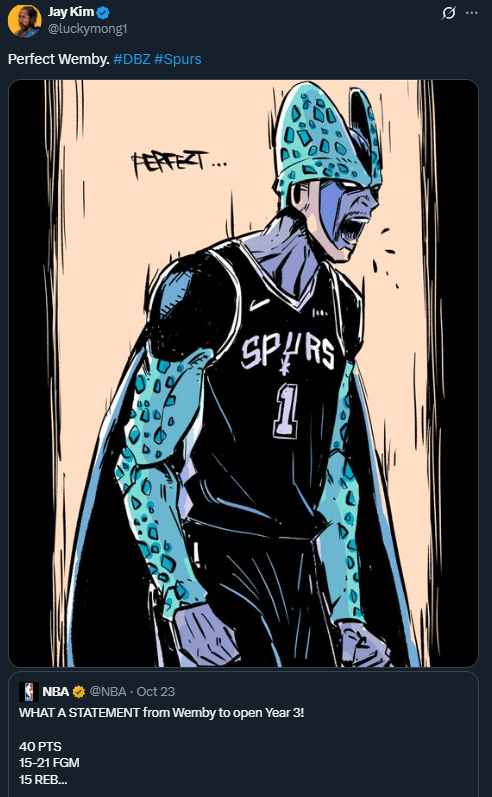

But then, something funny happened throughout the day of the 23rd. The highlights made the rounds, the fanart was fabulous, jokes about him training with warrior-monks were made.

Amid this chatter, his odds rose yet again, climbing 25% notionally to 26.5% overall.

Crucially, unlike with the game and the resulting highlights, there was no new information. This was a byproduct of social media, Sportscenter, and the global sports media hype machine. This second leg of the Oct 23rd spike -- and arguably a portion of the first -- was driven entirely by sports fan emotion.

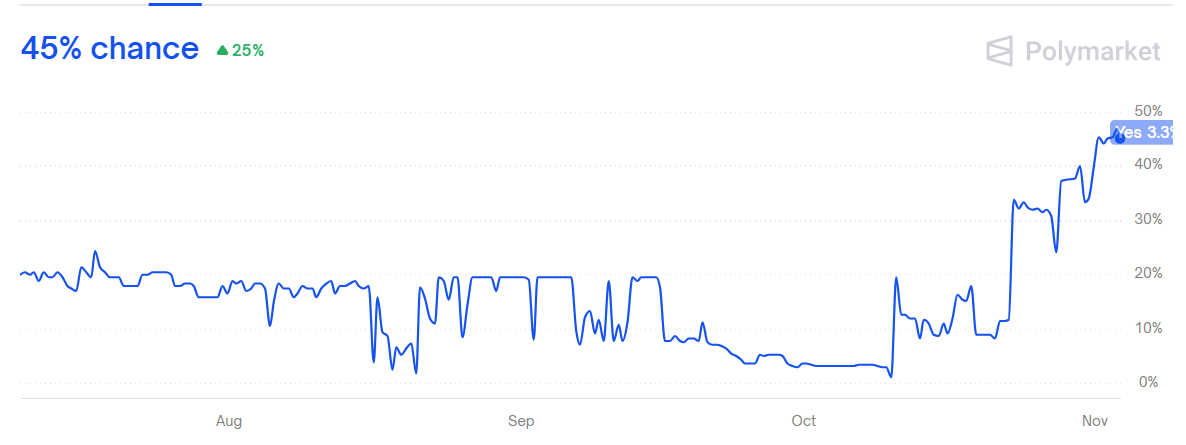

Another example: VJ Edgecombe’s impressive rookie debut and subsequent strong performances. Each of the upward legs on this chart represents another successful game/social media hype cycle:

And the chart for the Cavalier’s odds to become 2025 NBA champions, topping at 10x the preseason lows after a strong (and improbable, emotion-inducing) run of “ethical basketball”:

So, what’s the thesis here?

Briefly, let’s sum up the core investment thesis one can use to approach sports betting on prediction markets, using the game theory of Lodden Thinks: because these are emotional, inefficient, and reflexive markets, smart bettors can enter and exit trades prior to settlement based on predicted emotional swings.

Later, we’ll break down a handful of multi-month theses, targeting markets where we predict an eventual pop of emotion to the tune of double to triple percentage point returns.

In the meantime, we’ll be buying any Wemby MVP dips. I mean, come on.